What is a trust?

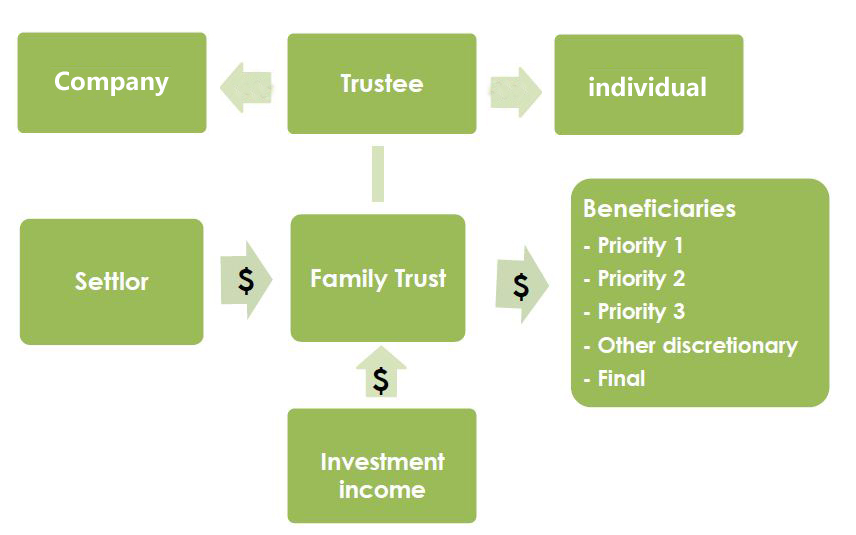

A trust involves a person or company owning assets on behalf of another person, family or group of people (known as the beneficiaries of the trust).

A trust is an arrangement which allows a person or company to own assets on behalf of another person, family or group of people. These people are known as the beneficiaries of the trust. Assets are owned on behalf of “beneficiaries” and are controlled by a “trustee” who can be either a corporation or a natural person. The trustee is governed by a “trust deed” which sets out the rules that the trustee must follow and also covers how profit is distributed to the beneficiaries.

What is a family trusts?

Family trusts are a type of discretionary trust where the beneficiaries of the trust are all related. For this reason they are often referred to as a “family discretionary trust”.

What are the benefits of a family trust?

Since, a family trust is like a discretionary trust, the income and profits from the trust can be distributed to the children or young adults that have lower taxable incomes.

Discretionary trusts are also used to assist protect assets in the event that one of the family members has a business failure or marriage breakdown.

Some families use a family trust as a method of passing assets to future generations.

Why borrow through a trust?

1. Asset protection

Asset protection is probably the biggest attraction of using a trust. Assets held through trusts are not legally "owned" by the trusts beneficiaries, meaning that trust assets are protected from the liabilities of those beneficiaries. Of course, the lender who lends to the trust will always protect themselves by requiring the appropriate guarantees and indemnities. All other creditors will be blocked from going after the assets of the trust though.

2. Tax benefits

The Government introduced the biggest tax advantage in choosing a trust rather than a company when it created a 50 per cent exemption from capital gains tax for all individuals. This exemption was explicitly extended to the beneficiaries of trusts, but not to the shareholders of companies.

Purchasing an investment property through a trust loan

Many people choose to purchase an investment property through a trust arrangement, as this offers tax advantages and asset protection. However, it is essential to arrange a trust loan through an experienced lender or mortgage broker, as many do not know how to structure these to ensure the tax advantages are available.

Additionally, many lenders do not offer trust loans. So, using an experienced mortgage broker to arrange a trust loan for your investment property purchase is a clever strategy, to save time, and to ensure you enjoy the maximum benefits of this type of lending.

How do trusts and borrowing through trusts work?

Homebuyers can set up a trust to borrow finance for a new home where the property will be held by a trustee, who is usually a company or a person. The home buyers will be the beneficiaries of that arrangement, meaning that the property is held on their behalf. The trustee takes up the home loan and guarantees its repayment, offering the beneficiaries more asset protection.

In most cases, borrowing through a trustee company benefits you as the lender as it helps you take advantage of tax benefits while giving you better asset protection. You do not legally own the property as the beneficiary and are therefore, protected from any borrowing liability. Obtaining finance for a home purchase through a trust company usually takes a lot longer, as there are more parties and paperwork involved.

Document checklist for a trust loan:

1. Family trust with corporate trustee (ABC Pty Ltd)

- Trust tax return, Profit & Loss statement, Balance Sheet (Last 2 years or 1 year)

- Directors personal tax return and NOA (ATO notice of assessment) (Last 2 years or 1 year)

- A certified copy of the stamped Trust deed

- ID of all directors and beneficiaries of the trust

- Copy of the company constitution

2. Family trust with an individual trustee

- Personal tax return and NOA (ATO notice of assessment) (Last 2 years or 1 year)

- A certified copy of the stamped Trust deed

- ID of all trustee and beneficiaries of the trust

Quick Links

Other trusts

Discretionary trust

A discretionary trust is a type of trust where the beneficiaries do not have fixed interest. Instead, the trustee determines which beneficiaries are to receive the trust funds and how much each is entitled to receive. However, the trustee must comply with the terms in the trust deed and any restrictions imposed when doing so.

This is unlike a unit trust where the trustee has no discretion and the trust funds are distributed to the beneficiaries in allotted units.

Typically, most discretionary trusts have nominated beneficiaries in the discretionary trust deed which allows income to be distributed to these beneficiaries as well as their family or friends.

Unit trust

A unit trust is like a company where the trust’s property is divided into a number of shares called units. The number of units you hold will determine your entitlement to your share of income, capital gains and voting power. Units in a unit trust can be categorised. For example, you can have income units and capital units. Also unit holders can be individuals, companies or discretionary trusts.

The taxation benefits are generally not as flexible in a discretionary trust, because any income distributions must be distributed to unit holders as per their share of units. However, if a discretionary trust was a unit holder, you can achieve the same flow through tax benefits.

From an asset protection point of view, unit trusts don’t provide the same kind of asset protection as a discretionary trust. If a unit holder is made bankrupt, then that person’s units will be treated like any other assets and sold to raise funds to pay creditors. Unit trusts are most common for non-family members or a blend of family and non-family members.

Residential rate loans to unit trusts are available through a limited number of lenders.

Hybrid trust

A hybrid trust is a mix between a discretionary trust and a unit trust. A discretionary trust is one in which there is no fixed entitlement or interest to beneficiaries, but rather the amount that the beneficiary receives is at the discretion of the trustee.