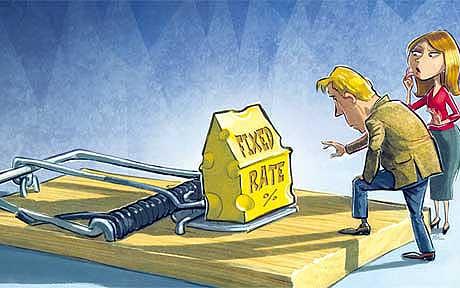

What is fixed rate?

How does a fixed rate benefit me?

A fixed rate home loan benefits those who want to budget with confidence and don’t want their repayments rising due to higher interest rates. A fixed rate home loan is ideal for borrowers who want to budget with certainty, first-home buyers who are adapting to the routine of making regular repayments, and investors who want to ensure that their cash flow isn’t affected by rising interest rates.

If you fix your rate at the bottom of the market, you can reap the benefit of a secure and competitive rate when the rest of the market bears the risk of higher interest rates.

In an economic climate of low interest rates, opting for a fixed interest rate could help you pay off your home loan faster. By making the same periodic repayments, you’ll generally repay the principal down quicker than you would with a variable rate loan.

How does a fixed home loan work?

You can choose a fixed rate term of up to 15 years, but most Australians choose between one, three and five year fixed terms.

When you apply for a fixed rate home loan, your lender will typically offer you something called a rate lock. There’s a chance that interest rates will change between the time you apply and when you settle so a rate lock ensures that the rate you applied for stays with you through that process, which is usually about a month.

Unlike a variable rate home loan, additional repayments are either not allowed or limited to a certain amount each year. This is because your lender has secured your home loan from funding sources at a fixed rate as well, and paying your loan off early could result in financial loss for your lender.

Additional repayments has another effect on fixed rate loans, which doesn’t apply to variable rate loans — early repayment fees. Paying off a fixed rate home loan during the fixed term usually comes with early repayment fees, also known as break costs. Break costs are determined using the amount of time you still have left in your term, the amount you borrowed, and the interest rate you locked in compared to what your lender secured funds for.

Fixed rate home loans also usually don’t offer features such as 100% offset accounts, although some fixed home loans will offer a partial offset account. Otherwise, a fixed rate home loan works in the same way as a variable home loan: you make your repayments each week, fortnight or month.

What are the pros and cons of a fixed rate mortgage?

A range of benefits and drawbacks are associated with a fixed rate home loan which are discussed below.

Pros

- Repayment certainty. One of the benefits of opting for a fixed-rate home loan is that it offers you the peace of mind in knowing what your periodic repayments will be. This allows you to budget more effectively as repayments remain the same until the fixed rate period ends.

- Security. With a fixed-rate home loan you are protected from interest rate rises as your interest rate is locked in for the specified term.

- Flexible loan terms. Fixed-rate mortgages are available from many Australian lenders with a variety of fixed loan terms available from one year through to 15 years.

Cons

- Limited features. You’ll find that fixed rate loans don’t have a lot of flexibility compared to variable rate mortgages. Typically, lenders won’t let you make additional repayments on the fixed portion of your home loan, so you may incur a fee for depositing a work bonus or tax return into your home loan. Other restrictions may include not having access to a 100% redraw facility which is generally only offered with variable rate loans. While most lenders don’t offer fixed home loans with a 100% offset account.

- Break costs. If you decide to break out of a fixed rate loan before the end of the specified term, you may face a significant break cost.

- Lower rates. If the RBA slashes the cash rate, you could end up with a higher rate compared to variable home loans on the market.