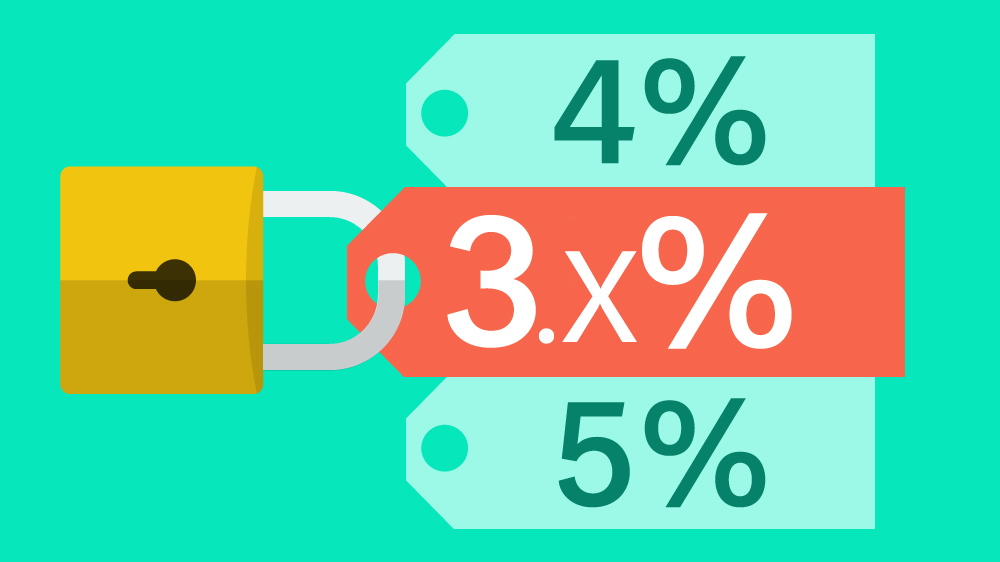

Lock in a low rate before it’s too late

Rates are tipped to rise soon

With speculation increasing that the United States’ Federal Reserve will lift the official cash rate, there’s also growing speculation that Australia’s Reserve Bank, and in turn our lenders, will follow suit.Interest rates are at record lows but they won’t stay this low forever.

A number of lenders have increased rates on their fixed rate home loans last month. Is this a sign that interest rates are going back up?Don’t wait until it’s too late to lock in a great home loan,say mortgage specialists and financial analysts.

Consider a fixed rate loan

While interest rates are still at record lows, it could be a good time to consider locking in a low rate fixed loan.With your loan rate fixed, you’re protected against future rate hikes for the duration of your chosen term. Once you go with a fixed home loan, during that period you know exactly how much you’re going to need to cover your mortgage costs each month, it’s easier to plan for the future.

It’s important to explore the pros and cons of fixed rate loans before deciding on the option that suits you. We’ll help you make the right decision.